The New Ledger: How Digital Transformation and ERP are Reengineering the Finance and Insurance Industry

2025-10-29 · By Anil Kancharla · 6 min read

❤️ 0 Likes · 👁️ 0 Views

AI-generated image for illustration purposes only.

AI-generated image for illustration purposes only.

Beyond the Magic: How Digital Transformation and ERP are Reengineering the Motion Picture and Sound Recording Industries

AI-generated image for illustration purposes only.

AI-generated image for illustration purposes only.

The New Ledger: How Digital Transformation and ERP are Reengineering the Finance and Insurance Industry

The Finance and Insurance (F&I) industry has long been the bedrock of the global economy, built on a foundation of stability, trust, and risk management. But that foundation is now experiencing a seismic shift. As we navigate 2025, the sector is contending with a perfect storm of macroeconomic volatility, sophisticated cybersecurity threats, intense regulatory pressure, and a new generation of customers who demand a seamless, personalized digital experience.

The era of siloed data, legacy mainframe systems, and paper-based processes is over. To survive and thrive, F&I institutions must become agile, data-driven, and hyper-efficient. This is not a simple upgrade; it is a fundamental digital transformation. And the central nervous system powering this new, intelligent enterprise is modern Enterprise Resource Planning (ERP) software.

This in-depth post explores the critical digital transformation opportunities for F&I companies and how a modern ERP is the key to unlocking them.

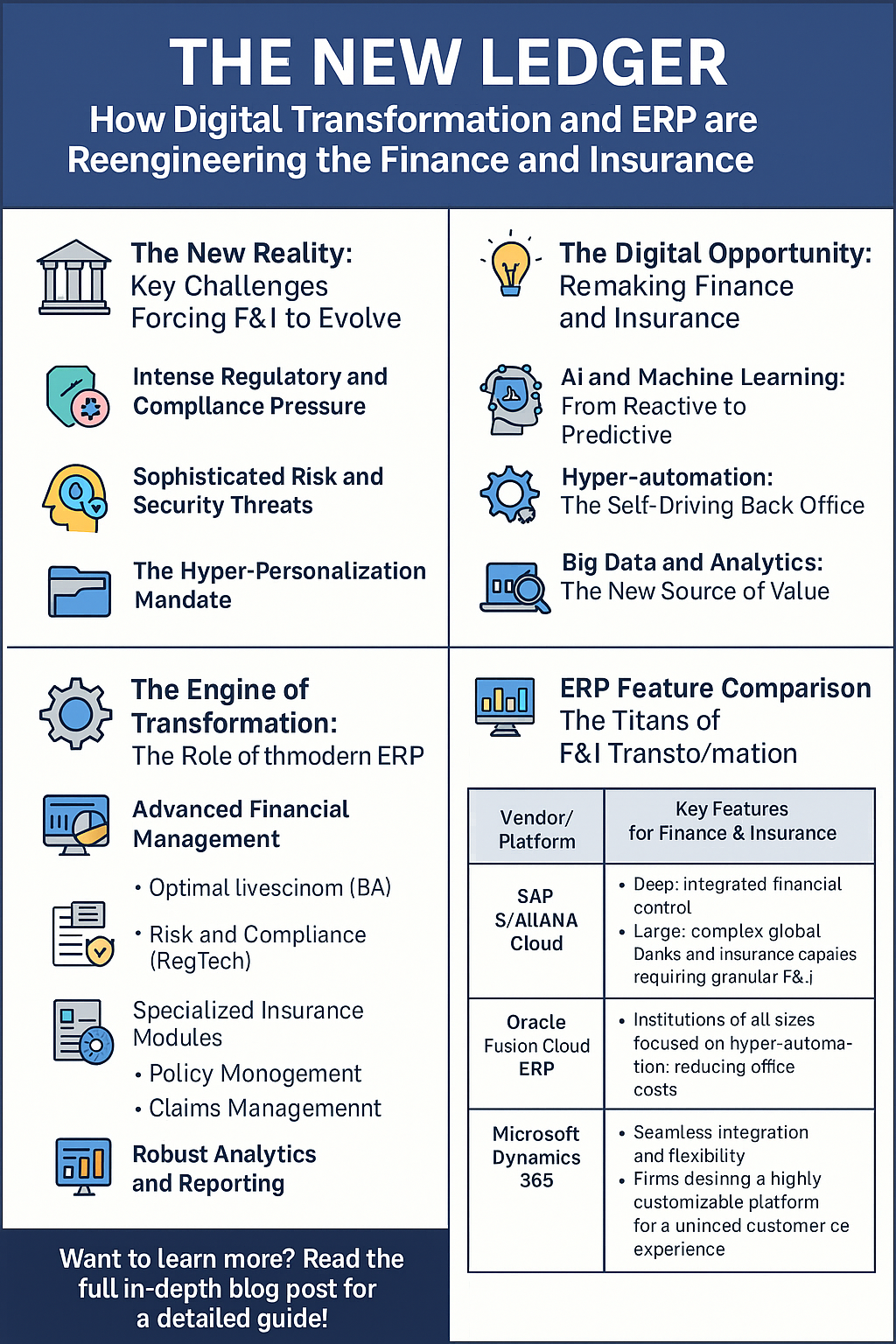

🏛️ The New Reality: Key Challenges Forcing F&I to Evolve

Today's F&I leaders are navigating a landscape of unprecedented challenges. The old playbook is no longer effective when the game itself has changed.

- Intense Regulatory and Compliance Pressure: From IFRS 17 in insurance to new ESG (Environmental, Social, and Governance) reporting mandates and evolving data privacy laws, the compliance burden is immense. Regulators demand more granular data, faster reporting, and provable audit trails.

- Sophisticated Risk and Security Threats: The digital landscape has opened new doors for criminals. AI-powered fraud, deepfake technology for impersonation, and complex cybersecurity attacks are no longer theoretical—they are daily threats that can cost billions.

- The Hyper-Personalization Mandate: The "one-size-fits-all" bank account or insurance policy is dead. Customers, conditioned by the experiences of tech giants, expect their financial institutions to know them, anticipate their needs, and offer personalized products and advice in real-time.

- Operational and Data Silos: For decades, the industry has grown by bolting on new systems. The result? A tangled web of legacy platforms where policy data can't talk to claims data, and customer data is fragmented across a dozen different applications. This makes it impossible to get a single, unified view of the customer or the business.

💡 The Digital Opportunity: Remaking Finance and Insurance

These challenges are also massive opportunities for those willing to embrace new technology. Digital transformation is not just about cost-cutting; it's about building a fundamentally smarter, faster, and more resilient business.

1. AI and Machine Learning: From Reactive to Predictive

Artificial intelligence is the single most significant opportunity. Instead of just reporting what happened, AI can predict what will happen next.

- For Finance: AI-driven models can analyze market data, geopolitical news, and internal cash flows to create incredibly accurate financial forecasts. It automates the reconciliation of millions of transactions, freeing finance teams to focus on strategy.

- For Insurance: AI is revolutionizing underwriting by analyzing thousands of data points to price risk with pinpoint accuracy. In claims, AI can instantly analyze a photo of a car accident, assess the damage, and approve the claim in minutes, not weeks.

2. Hyper-Automation: The Self-Driving Back Office

This goes beyond simple automation. It’s about end-to-end process reengineering. In insurance, this means automated claims processing—a claim is filed online, verified by AI, checked against the policy, and paid out, all with minimal human touch. In banking, it means automated KYC (Know Your Customer) and anti-money laundering (AML) checks, onboarding new customers securely in seconds.

3. Big Data and Analytics: The New Source of Value

F&I companies are sitting on mountains of data. The opportunity is to finally make sense of it. By analyzing customer transaction and behavior data, banks can proactively offer a mortgage at the exact moment a customer starts looking for a house. Insurance companies can use IoT data from a connected car to offer usage-based insurance (UBI), rewarding safe drivers.

4. The Rise of Customer Self-Service

Customers want control. They expect to be able to file an insurance claim from a mobile app, apply for a loan on a website, and manage their investment portfolio without ever speaking to a person. This requires a seamless, user-friendly digital channel that is available 24/7.

⚙️ The Engine of Transformation: The Role of the Modern ERP

How does an institution with decades of legacy systems possibly achieve this? It can't be done with a patchwork of solutions. It requires a new digital core—a modern, intelligent ERP.

A traditional ERP was just a financial ledger. A modern ERP for F&I is a unified data and operations platform that breaks down silos and serves as the single source of truth for the entire organization.

Key ERP Modules and Features for Finance & Insurance:

- Advanced Financial Management: This is the core. It includes a General Ledger (GL) that can handle multi-entity, multi-currency consolidations in real-time. It automates Accounts Payable (AP) and Accounts Receivable (AR), using AI to predict late payments and optimize cash flow.

- Risk and Compliance (RegTech): This module is non-negotiable. It provides a real-time, auditable trail for every transaction. It helps automate the complex reporting required by regulators and uses AI to continuously monitor for fraudulent activity and compliance breaches.

- Specialized Insurance Modules:

- Policy Management: A central hub for creating, managing, and renewing all policies, from underwriting to billing.

- Claims Management: Manages the entire claims lifecycle, from first notice of loss to final payment, integrating with other systems to automate verification and processing.

- Robust Analytics and Reporting: Modern ERPs have powerful business intelligence (BI) tools built-in. This allows a CFO to go from a high-level profitability report down to a single transaction with just a few clicks. For insurers, it means analyzing claims data to spot emerging risk trends.

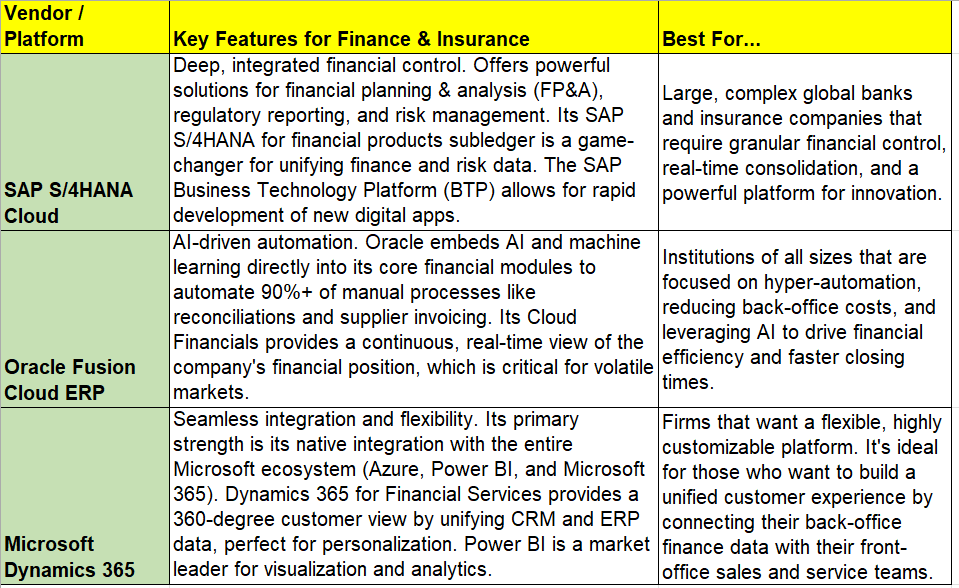

📊 ERP Feature Comparison: The Titans of F&I Transformation

🚀 The Future-Proof Institution: A Final Word

The finance and insurance industry is at a crossroads. The choice is to either be disrupted by new, agile fintech competitors or to become the disruptor. True digital transformation is not about buying a single piece of software; it's about fundamentally reengineering the business around data and intelligence.

A modern, intelligent ERP is the essential foundation for this change. It is the platform that breaks down the silos of the past, automates the processes of the present, and provides the data-driven insights needed to win the future.

💌 Enjoyed this article?

If you found this post valuable, subscribe to my newsletter for more insights on digital transformation, AI, and business innovation.

👉 Subscribe to the newsletterOr let’s connect on LinkedIn — I share weekly content that’s practical for CIOs, CFOs, and transformation leaders.

🔗 Connect with me on LinkedIn