The Death of Greenwashing: Why Sustainability is Now a Data & Risk Management Problem

2026-01-01 · By Anil Kancharla · 4 min read

❤️ 0 Likes · 👁️ 0 Views

AI-generated image for illustration purposes only.

AI-generated image for illustration purposes only.

The Death of "Greenwashing": Why Sustainability is Now a Data & Risk Management Problem

AI-generated image for illustration purposes only.

AI-generated image for illustration purposes only.

The Death of "Greenwashing": Why Sustainability is Now a Data & Risk Management Problem

In the early days of corporate social responsibility (CSR), "sustainability" was often a department tucked away in marketing. Success was measured in glossy brochures, high-quality photography of wind turbines, and vaguely optimistic promises of a "greener future."

Those days are over.

We are witnessing the death of greenwashing—not because companies have suddenly found a moral compass, but because the global regulatory and financial landscape has shifted. Today, sustainability has moved from the PR desk to the Risk Management and Data Governance offices. In 2025, a misleading environmental claim isn’t just a "marketing fail"; it is a significant financial liability and a legal landmine.

The Rising Cost of Misleading Claims: 2025 ESG Statistics

According to the KPMG 2025 Global CEO Outlook, greenwashing risk is no longer a fringe concern; it is a systemic business threat. Data shows that one in every four climate-related ESG risk incidents is now tied to greenwashing.

- Greenwashing Risk Spike: The percentage of companies linked to greenwashing risk incidents has risen globally, with UK and EU companies seeing a jump to 4.4% in 2025.

- Consumer Backlash: 54% of consumers state they would stop buying from a company found to have greenwashed.

- Investor Pressure: 85% of investors now report that greenwashing is a major hurdle in their decision-making.

- Climate Litigation: Over 3,000 climate-related lawsuits have been filed globally as of mid-2025, primarily targeting unsubstantiated net-zero claims.

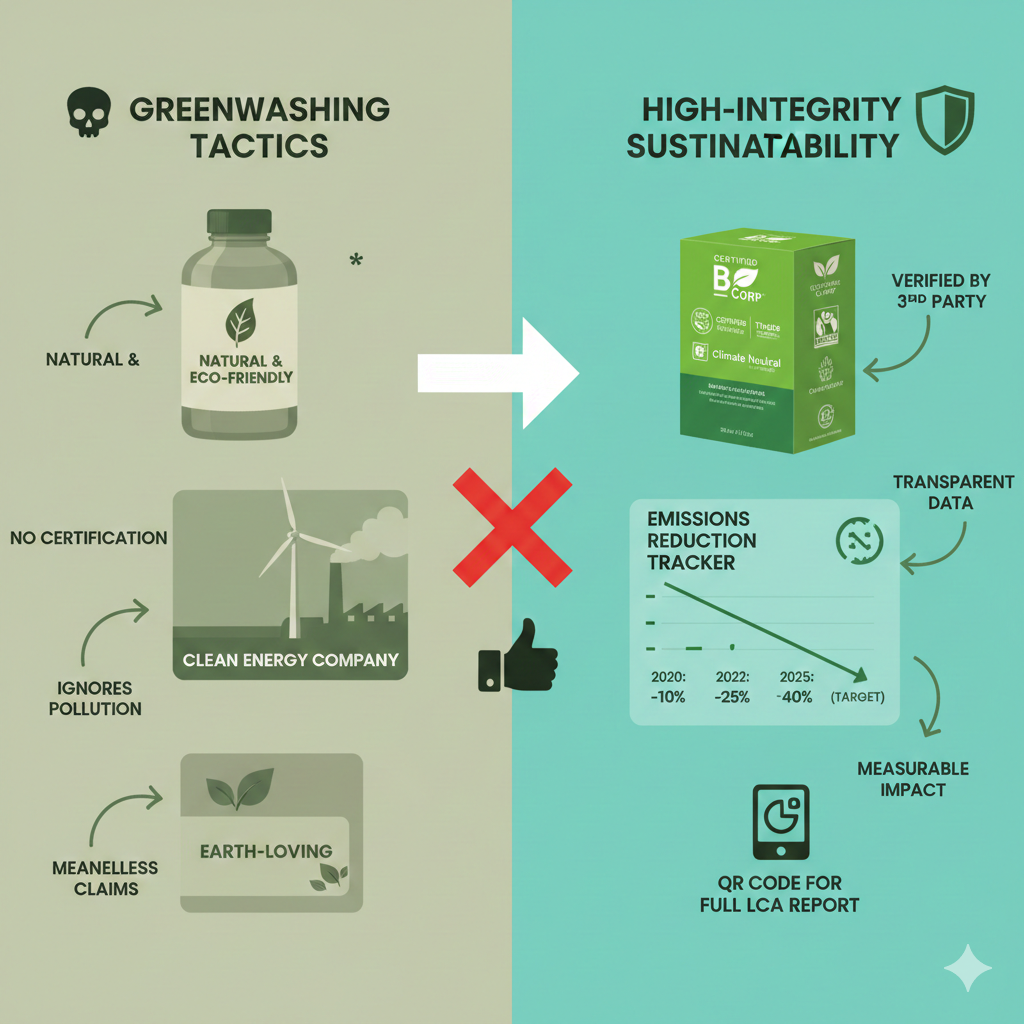

What is Greenwashing, Really?

The term was coined in 1986 by environmentalist Jay Westerveld, who exposed a hotel for requesting towel reuse "for the planet" while simultaneously destroying local ecosystems. Today, greenwashing takes more sophisticated forms: Unsubstantiated Claims (e.g., "100% eco-friendly" without proof), Hidden Trade-offs (ignoring a massive footprint to highlight one minor green win), and Vague Labels (using terms like "carbon neutral" without high-integrity offsets).

The Data Revolution: From Narrative to Numbers

The antidote to greenwashing is rigorous ESG data management. Reporting on carbon emissions is moving from "estimates" to "audit-ready" financials. Under regulations like the EU's CSRD and SEC climate rules, companies must account for:

- Scope 1: Direct emissions (owned sources).

- Scope 2: Indirect emissions (purchased energy).

- Scope 3: The Value Chain (emissions from suppliers and product end-of-life).

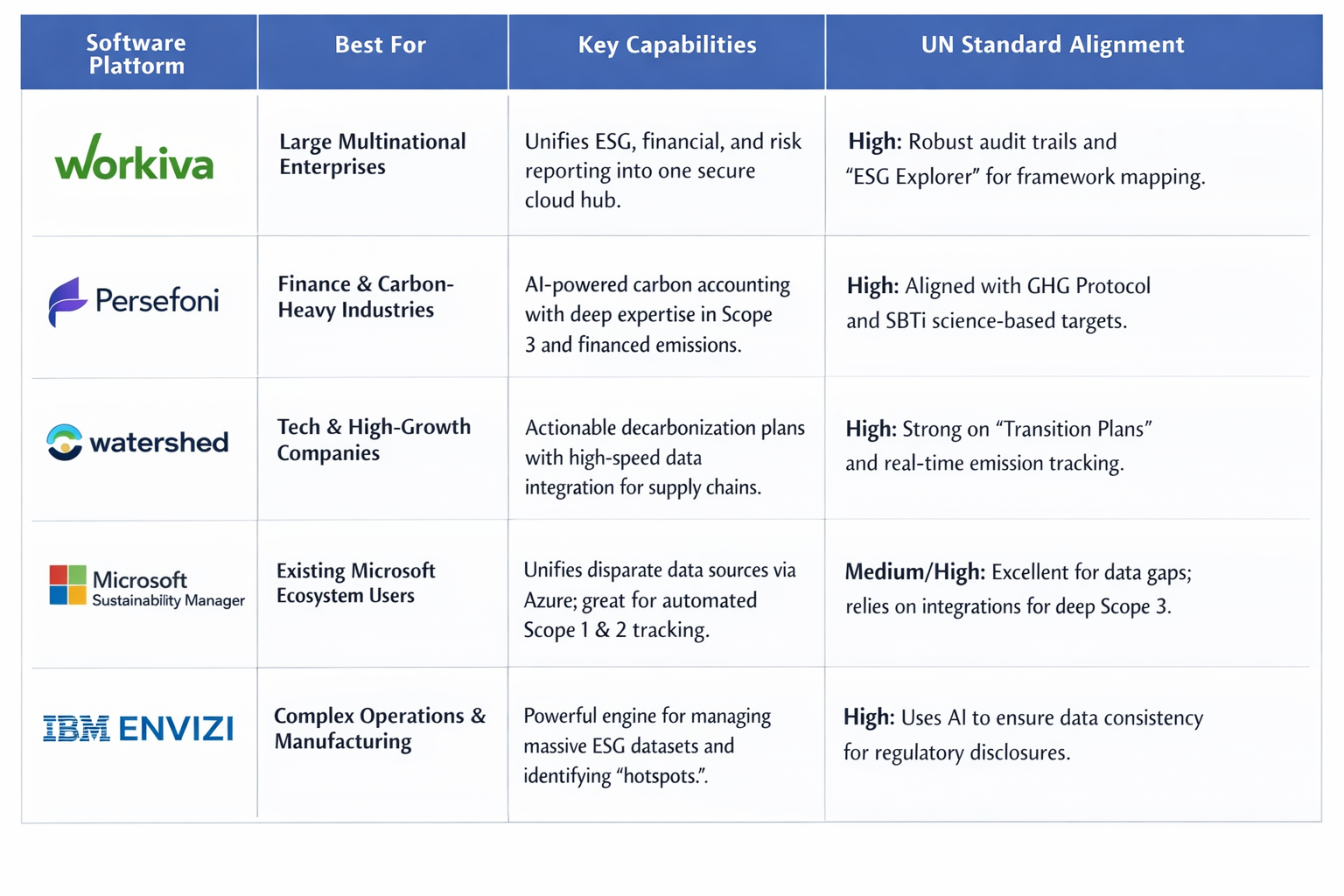

Comparing the Top 5 ESG Software Tools for 2026

To meet the UN’s "Integrity Matters" standards, companies are ditching spreadsheets for specialized platforms. Below is a comparison of the leading tools helping businesses achieve "Audit-Ready" sustainability.

AI-generated image for illustration purposes only.

AI-generated image for illustration purposes only.

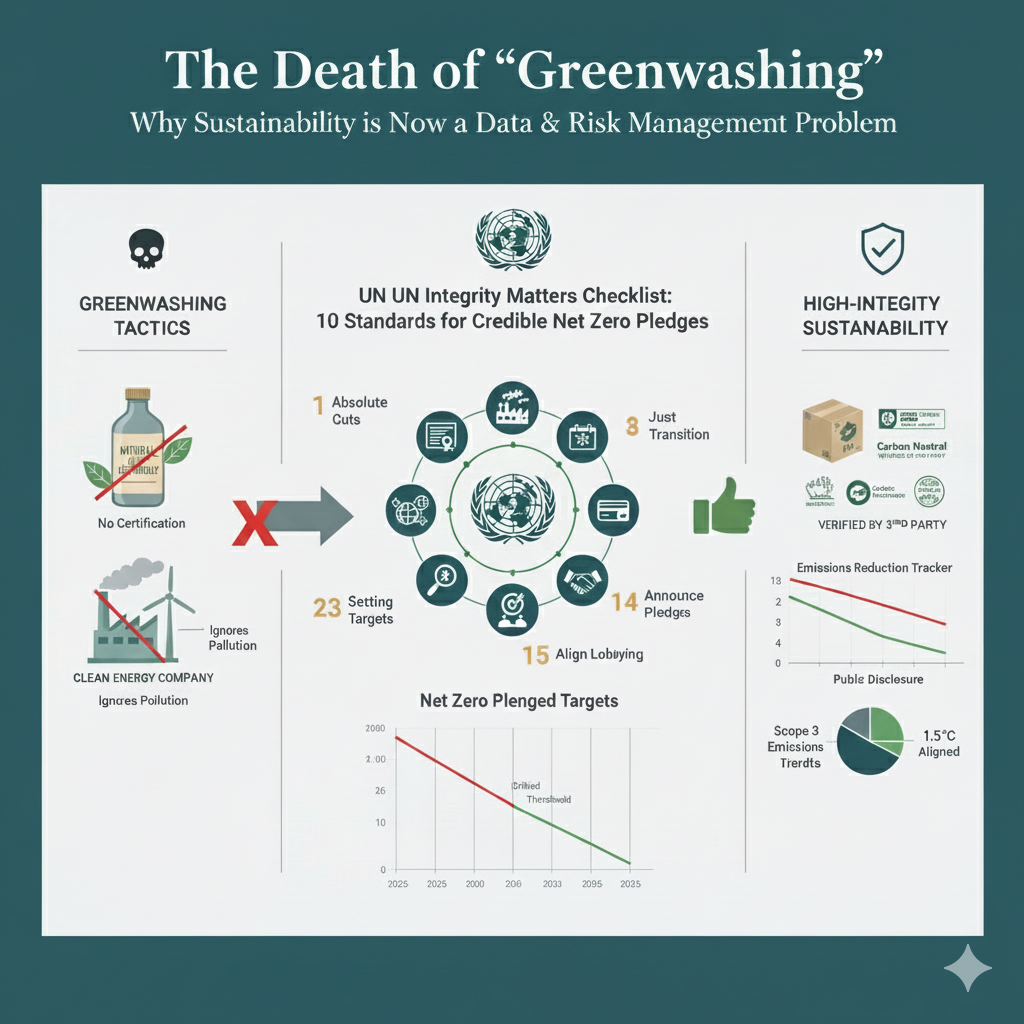

📋 The UN 10-Point Checklist for High-Integrity Pledges

AI-generated image for illustration purposes only.

AI-generated image for illustration purposes only.

The UN Secretary-General’s High-Level Expert Group released the "Integrity Matters" report to set a "red line" for greenwashing. Use this checklist to verify any corporate net-zero claim:

- Public Pledge: Must include interim targets for 2030 and 2035 on the road to 2050.

- Absolute Reductions: Targets must be based on actual emission cuts, not "intensity" metrics.

- Third-Party Verification: All data must be audited by an independent, accredited body.

- Scope 3 Inclusion: Pledges must cover the entire value chain (Scope 3), not just direct ops.

- No New Fossil Fuels: The plan must explicitly end investment in coal, oil, and gas expansion.

- Transition Plan: A publicly available roadmap showing capital expenditure (CapEx) alignment with 1.5°C.

- Offset Integrity: Carbon credits can only be used for residual emissions (the final 10%)—not to replace actual cuts.

- Lobbying Alignment: Corporate lobbying and trade associations must support, not hinder, climate policy.

- Just Transition: The plan must protect biodiversity and respect indigenous rights and labor.

- Radical Transparency: Annual progress must be reported to the UNFCCC Global Climate Action Portal.

Conclusion: Data is Your New Best Friend

The death of greenwashing is a sign of maturity. We have moved past "doing good" as an optional PR exercise and into the era of Total Accountability.

For businesses, the message is clear: You cannot manage what you do not measure. As we head toward 2030, the companies that thrive will be those that treat their carbon ledger with the same integrity as their financial ledger.

Ready to start your reporting journey? Check out the UN Climate Action Portal to see how your favorite brands measure up.

💌 Enjoyed this article?

If you found this post valuable, subscribe to my newsletter for more insights on digital transformation, AI, and business innovation.

👉 Subscribe to the newsletterOr let’s connect on LinkedIn — I share weekly content that’s practical for CIOs, CFOs, and transformation leaders.

🔗 Connect with me on LinkedIn