From Brick and Mortar to Bits and Data: The Digital Transformation of Real Estate and the Power of ERP

2025-11-05 · By Anil Kancharla · 9 min read

❤️ 0 Likes · 👁️ 0 Views

AI-generated image for illustration purposes only.

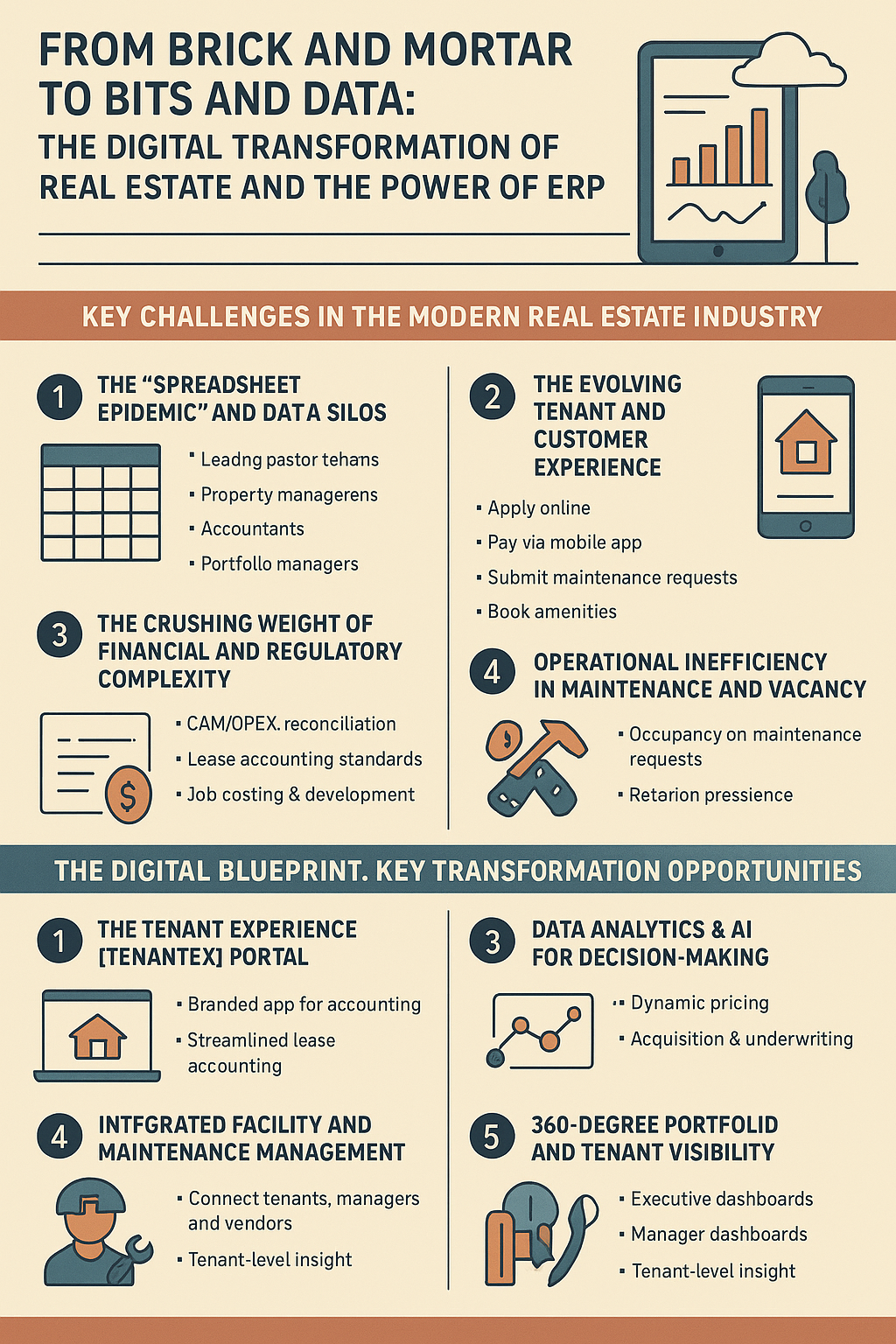

AI-generated image for illustration purposes only.

From Brick and Mortar to Bits and Data: The Digital Transformation of Real Estate and the Power of ERP

AI-generated image for illustration purposes only.

AI-generated image for illustration purposes only.

From Brick and Mortar to Bits and Data: The Digital Transformation of Real Estate and the Power of ERP

For over a century, the real estate industry ran on a simple, unchanging mantra: "location, location, location." Today, that mantra is being replaced. The new formula for success is "data, experience, and efficiency."

The Real Estate and Rental and Leasing industry—a vast sector encompassing commercial property, residential portfolios, brokerages, and industrial spaces—is in the midst of a profound technological revolution. The days of filing cabinets overflowing with paper leases, managing critical dates on spreadsheets, and a "rent check in the mail" tenant experience are numbered.

As of 2025, modern property owners and managers are facing a new set of demands. They must be financial analysts, data scientists, hospitality experts, and tech innovators. This shift is being driven by digital transformation, and the foundational technology making it all possible is a modern Enterprise Resource Planning (ERP) system.

This in-depth blog post will explore the challenges and opportunities of this new era and explain why an integrated Real Estate ERP is no longer a luxury, but the central nervous system for survival and growth.

The Shaky Foundation: Key Challenges in the Modern RealE-state Industry

Before we can build the future, we must understand the cracks in the present foundation. Most property management companies and real estate firms are grappling with a core set of challenges that stifle growth and eat into profitability.

1. The "Spreadsheet Epidemic" and Data Silos

For decades, the industry's most critical financial instrument—the lease—has been managed on a spreadsheet. This is a high-risk, low-efficiency model. Different departments all run on their own disconnected systems:

- Leasing agents use a CRM to track prospects.

- Property managers use one system for maintenance requests.

- Accountants use a generic finance package for the General Ledger.

- Portfolio managers use complex Excel models for analysis.

The result is a data nightmare. There is no single source of truth. Answering a simple question like, "What is our total rent exposure from tenants with leases expiring in the next 12 months?" can take days of manual reconciliation.

2. The Evolving Tenant and Customer Experience

The "Amazon effect" has reached real estate. Today's tenants, whether residential or commercial, expect a seamless, digital experience. They want to:

- Apply for a lease online.

- Pay rent and fees via a mobile app.

- Submit a maintenance request (with a photo) from their phone.

- Book amenities and receive package notifications digitally.

A slow, paper-based, 9-to-5 management office is a source of friction that leads to high turnover and damages your brand's reputation.

3. The Crushing Weight of Financial and Regulatory Complexity

Real estate accounting is notoriously complex. It's not just about collecting rent.

- CAM/OPEX Reconciliation: For commercial properties, calculating and reconciling Common Area Maintenance charges is a time-consuming, error-prone process that is a frequent source of disputes.

- Lease Accounting Standards: The new ASC 842 and IFRS 16 standards have turned leases into balance sheet liabilities. This requires complex calculations and disclosures that are nearly impossible to manage accurately on spreadsheets.

- Job Costing & Development: For firms that develop or renovate properties, tracking the complex costs of a construction project against its budget is a massive challenge.

4. Operational Inefficiency in Maintenance and Vacancy

Every day a unit is vacant is a day of lost revenue. Every time a maintenance request is handled slowly, tenant satisfaction plummets. In a disconnected system, a tenant's email to the property manager about a leak must be manually re-entered into a work order system, which must then be manually approved and dispatched. This friction adds days to the process, increasing costs and frustrating tenants.

The Digital Blueprint: Key Transformation Opportunities

These challenges are immense, but the technological opportunities to solve them are even greater. This is the rise of "PropTech" (Property Technology) as a core part of the business.

- 1. The Tenant Experience (TenantEx) Portal: This is the new "front door" of your business. A modern TenantEx portal is a branded app that provides a single touchpoint for the entire tenant lifecycle—from online payments and maintenance requests to community announcements and amenity bookings. It's the most visible and valuable tool for improving tenant retention.

- 2. Data Analytics & AI for Decision-Making: Instead of relying on "gut feeling," leading firms are using data to drive strategy.

- Dynamic Pricing: AI models can analyze market comps, seasonality, and internal vacancy data to recommend the optimal rent price for a unit, balancing occupancy and revenue.

- Acquisition & Underwriting: Firms can analyze vast datasets to identify promising acquisition targets and model future performance with far greater accuracy.

- 3. The "Smart" Building and IoT: The Internet of Things (IoT) is moving from concept to reality. Smart sensors can monitor HVAC and lighting systems to reduce energy costs. They can also enable predictive maintenance—a sensor on an HVAC unit can alert you to a potential failure before it breaks, allowing you to schedule maintenance instead of reacting to a costly emergency.

- 4. Automation of the Lease-to-Cash Cycle: Digital transformation allows you to automate the entire financial workflow. This includes automatic rent posting, late fee calculation, invoice delivery, and processing of digital payments, which dramatically improves cash flow and reduces administrative overhead.

The Command Center: ERP as the Single Source of Truth

How do you manage all these new technologies—IoT sensors, AI models, tenant portals—without creating new data silos?

The answer is a Real Estate ERP.

A generic ERP is not enough. A true Real Estate ERP (often called an integrated Property Management System) is a single, unified platform that combines a powerful financial core (the ERP) with a complete set of property management and operational tools (the PMS).

It is the single source of truth that connects a tenant's lease to the company's balance sheet.

1. Unified Financial Management (The Core)

The ERP's General Ledger is the heart of the operation. Every dollar is tracked from its source to the financial statements.

- Automated CAM/OPEX Reconciliation: The system automatically pulls all building operating expenses, allocates them based on the complex rules in each tenant's lease, and generates accurate invoices, turning a week-long manual nightmare into a one-click process.

- Streamlined Lease Accounting: A real estate ERP has a built-in module to handle ASC 842/IFRS 16. It automatically calculates the right-of-use asset and liability, generates the required amortization schedules, and produces the disclosure reports needed for your auditors.

2. End-to-End Lease Administration

The ERP digitizes the lease and becomes the system of record for every critical date, clause, and financial obligation.

- Critical Date Management: The system automatically tracks and sends alerts for key dates like lease expirations, renewal options, and rent escalations.

- Automated Rent Escalations: It automatically applies rent increases (e.g., fixed bumps, CPI-based) as defined in the lease, ensuring you never miss a dollar of revenue.

3. Integrated Facility and Maintenance Management

This connects your tenants, your managers, and your vendors on one platform.

- The Workflow: A tenant submits a maintenance request in the portal. A work order is automatically generated and dispatched to a technician's mobile device. The tech can see the unit's history, order parts from an integrated inventory, and mark the job complete. The tenant is notified, and any billable charges are automatically posted to their ledger. This seamless flow cuts resolution times from days to hours.

4. 360-Degree Portfolio and Tenant Visibility

With all data in one place, the power of analytics is finally unlocked.

- Executive Dashboards: The CFO and CEO can see real-time portfolio health at a glance: portfolio-wide occupancy, net operating income (NOI), cash flow, and budget variance.

- Manager Dashboards: A property manager can see their building's key metrics: units leased vs. vacant, delinquencies, and open work orders.

- Tenant-Level Insight: You can track the entire relationship with a tenant, from on-time payment history to service request frequency, giving you a clear picture of your most and least profitable tenants.

Choosing Your System: A Look at Leading Real Estate ERPs

The market for real estate ERPs is vast, but it generally breaks down into a few key categories.

- The End-to-End Specialists (e.g., Yardi, RealPage, MRI): These platforms are purpose-built for the real estate industry. They offer incredibly deep, end-to-end functionality for specific verticals (e.g., multifamily, commercial, retail). Their primary strength is that everything is in one system, from the first prospect inquiry to the final financial statement.

- The Global Enterprise Platforms (e.g., SAP, Oracle): These are for large, global, diversified corporations where real estate is one part of a much larger business (e.g., a fast-food chain managing its own stores, or a global bank managing its corporate facilities). Their Real Estate modules are powerful and plug directly into the global corporate financial system.

- The Flexible Cloud ERPs (e.g., NetSuite, Microsoft Dynamics 365): These are a popular choice for growing, dynamic portfolios. They offer a world-class, flexible financial core (the ERP) and then integrate with "best-of-breed" property management applications or partner-built add-ons. This gives firms flexibility and a powerful, modern financial backbone.

The Final Blueprint

The real estate industry is no longer just about the physical assets you own; it's about the efficiency with which you operate them and the experience you provide to the people who occupy them.

Digital transformation is the blueprint for this new business model. A modern, integrated ERP is the foundation you pour. It connects your properties, your people, and your processes to a single source of truth, giving you the data-driven insight you need to build a more resilient, profitable, and tenant-focused portfolio.

💌 Enjoyed this article?

If you found this post valuable, subscribe to my newsletter for more insights on digital transformation, AI, and business innovation.

👉 Subscribe to the newsletterOr let’s connect on LinkedIn — I share weekly content that’s practical for CIOs, CFOs, and transformation leaders.

🔗 Connect with me on LinkedIn